In recent years, Malta has become one of the biggest gambling hubs on the Old Continent. This small island country, located in the Mediterranean Sea has been a host to numerous poker tournaments, including the prestigious 2016 European Poker Tour, but more importantly, it is home to one of the most stringent gambling regulatory bodies in the world, namely the Malta Gaming Authority.

It makes sense Malta has always been a major driving force behind the gambling industry’s growth and its plans to introduce the first blockchain regulatory legislation in the world are the most recent example for this.

It all started in the spring of 2017 when the country’s Prime Minister Joseph Muscat unveiled the first draft of Malta’s strategy to promote and regulate the blockchain technology. Muscat revealed at the time this cryptocurrency technology has multiple applications as it can be also implemented in the country’s national Health and Land Registries.

In January 2018, the Maltese Financial Services Parliamentary Secretary Silvio Schembri revealed the country’s plans to become the first jurisdiction in the world to create a regulatory framework for the blockchain technology. Three separate bills were introduced for public consultation and once this process is concluded, the Maltese government will present them to the Parliament.

Malta Introduced Three Blockchain Bills for Public Consultation

The first bill is the MDIA bill which has to do with the creation of a framework for the Malta Digital Innovation Authority. The latter will be assigned the role of a central regulatory authority, whose purpose will be that of overseeing the operations of all entities that deploy the cryptocurrencies and to provide them with incentives to base their businesses in the island country.

The first bill is the MDIA bill which has to do with the creation of a framework for the Malta Digital Innovation Authority. The latter will be assigned the role of a central regulatory authority, whose purpose will be that of overseeing the operations of all entities that deploy the cryptocurrencies and to provide them with incentives to base their businesses in the island country.

The MDIA would also provide information on the ethical standards and the legitimate utilization of the Digital Ledger Technology or DLT. The MDIA would seek to promote and safeguard transparency and preserve Malta’s immaculate reputation of an established financial-services center in Europe.

The second bill that was proposed for public consultation is the TAS bill that aims at setting out a framework for the registration, assessment and certification of service providers of Digital Ledger Technologies on the territory of the country. This would enable individuals to request a certification for a technology arrangement from the MDIA. In order for the MDIA to even consider the request, the administrator of the requested technology arrangement needs to be registered with this authority.

And finally, the purpose of the last bill, the VC bill, is to introduce a framework applicable to the so-called Initial Coin Offerings (ICOs) as well as a proper regulation scheme for the provision of all services that relate to cryptocurrencies. Some of the intermediaries that would be subjected to the VC bill include cryptocurrency wallet providers, brokers, cryptocurrency exchanges, and asset managers.

When the bills are approved, they will regulate three types of platforms related to the Digital Ledger Technology – those intended for private users (for example banking institutions looking to adopt DLT platforms to pay employees’ salaries), private platforms that can be used by third parties, and fully public ones like Bitcoin, Litecoin, and Ethereum. The consultation process for the three bills is to continue until March 9, 2018.

The Blockchain Legislation Attracts International Interest

Several important regulatory bodies are involved in the consultation process concerning the three bills, namely the local gambling regulator the Malta Gaming Authority, the Malta Communications Authority, the local Financial Services Authority, and the Central Bank of Malta.

Several important regulatory bodies are involved in the consultation process concerning the three bills, namely the local gambling regulator the Malta Gaming Authority, the Malta Communications Authority, the local Financial Services Authority, and the Central Bank of Malta.

According to Mr Schembri , the blockchain regulations the country is preparing to adopt have already attracted overwhelming international interest. Several meetings with operators from Europe, Asia, and the United States have already taken place.

During his visit to Dubai in January 2018, Parliamentary Secretary Schembri also took the opportunity to meet with Dr Aisha Bint Butti Bin Bishr, who occupies the position of Director General of the Smart Dubai initiative. The discussions between the two were focused on exploring the opportunities for a potential cooperation between Malta and Dubai in relation to the development of the blockchain sector.

These discussions are likely to result in an agreement between the two countries, where Malta will share the considerable experience it has in terms of blockchain regulatory developments. It is possible for Malta and Dubai to partner on several projects related to the implementation of the blockchain technology in different sectors.

The Maltese Parliamentary Secretary also met with representatives of several major Dubai companies that operate in the Financial Services and Technology sector. The purpose of the meetings was to stimulate interest in the new opportunities for investments that will result from the creation of the blockchain regulatory authority in Malta. Schembri took the opportunity to invite interested companies to extend their operations in Malta. This move would also enable them to expand on other European markets.

Austria has also shown interest in introducing a regulatory framework for cryptocurrencies. Hartwig Loeger, the country’s Finance Minister, revealed last month the Austrian government plans on introducing a set of measures related to Initial Coin Offerings and will use the already existing rules pertaining to the blockchain market manipulation. Japan regulators are also planning to come up with a framework for the regulation of Initial Coin Offerings.

Bitcoin Defies Market Expectations in 2017

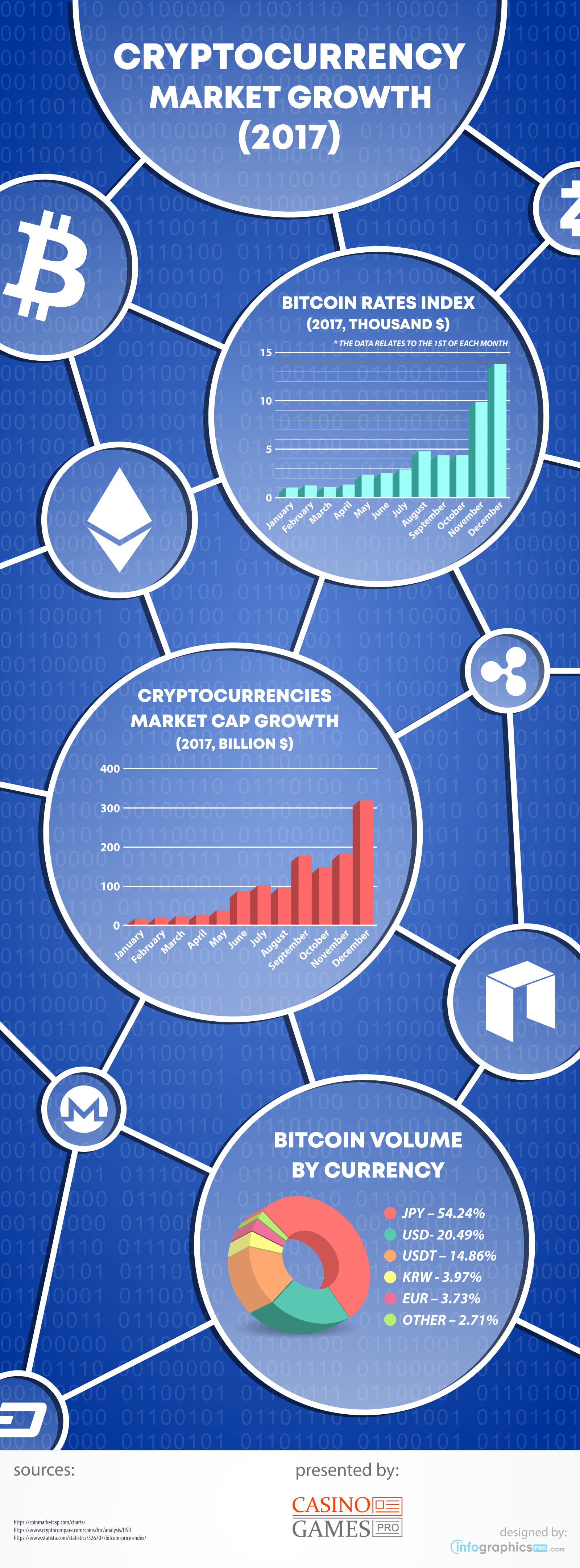

Last year was an important one for blockchain technologies as Bitcoin and other similar virtual currencies were officially acknowledged as part of the global financial system and their value increased significantly. As you can see from the charts, the cryptocurrency Bitcoin traded at $967.67 only at the beginning of 2017 but its rates have been increasing steadily for the remainder of the year.

Last year was an important one for blockchain technologies as Bitcoin and other similar virtual currencies were officially acknowledged as part of the global financial system and their value increased significantly. As you can see from the charts, the cryptocurrency Bitcoin traded at $967.67 only at the beginning of 2017 but its rates have been increasing steadily for the remainder of the year.

The increase in the last two months of the year was especially steep, with the rates reaching $9,916 in November and $13,860 in December. These positive trends are expected to continue in 2018 as well.

The same can be said about the growth of the overall cryptocurrency market cap which stood at $16.8 billion in January 2017 but gradually escalated to the staggering $319 billion in December of the same year.

As becomes evident by the graphics, Japan holds the largest percentage of Bitcoin cryptocurrency in the world. As much as 54.24% of the overall volume of Bitcoins is in the country’s local JPY. The Land of the Rising Sun is followed by the United States with 20.49% of the Bitcoin volume in USD.

The Applications of Blockchain Technologies to the Gambling Industry

The blockchain technology also applications to the oil and gas industry as it enables individuals to process instant and transparent transactions. What is more, the introduction of proper regulation of the blockchain technology bears the potential to transform the online gambling industry all over.

The blockchain technology also applications to the oil and gas industry as it enables individuals to process instant and transparent transactions. What is more, the introduction of proper regulation of the blockchain technology bears the potential to transform the online gambling industry all over.

In its essence, the blockchain technology is a digital ledger which allows for the storage of online financial transactions that rely on cryptocurrencies. This allows for a direct connection between consumers and suppliers to be established and eliminates the necessity of using the services of third parties like banking institutions, for example.

In comparison, each bank would use its own electronic ledger to store and synchronize its transactions whereas the digital ledgers of the blockchain technology are decentralized. This also means that the information related to the blockchain transactions can be accessed by all parties that are part of a given blockchain. The data is not controlled by a single entity or party.

Cryptocurrencies like Bitcoin, Litecoin and Ethereum have already made their way into the cashiers of numerous iGaming operators. One of the biggest advantages of using such virtual currencies for the purposes of online gambling results from the fact that decentralized technology adds an extra layer of transparency to the transactions. This aspect of the blockchain technology can also be used as an effective tool in the battle against money laundering.

Also, blockchain casinos would enable their customers to transfer money to their gambling accounts completely anonymously. The blockchain technology eliminates the need of sending over copies of personal documents for the purposes of identity and payment-method verification.

Another aspect of cryptocurrency that renders it ideal for online gambling has to do with the smaller transaction costs. Additionally, the time required for the transactions’ completion is greatly reduced and the deposits take place almost instantaneously.

The adoption of the blockchain technology makes it possible for online gambling regulators to prove they play by the rules and are fair to customers. Best of all, everyone can become a “member” of a given online casino, so to speak. Some Bitcoin gambling operators already allow their customers to fund them and profit with a percentage of the house edge.

This above idea is now taken to a whole new level thanks to cryptocurrency platforms like Ethereum and projects such as vSlice which make it possible to create a system that enables digital-token holders to get dividends from the profits the platform generates.

Last but not least, virtual currencies and the blockchain technology they rely on increasing the accessibility of online gambling services as they allow players to bypass stricter gambling regulations, applicable to fiat money transfers only. This is so because of the decentralized nature of cryptocurrencies.